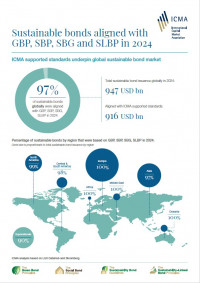

ICMA plays a recognised leading role in supporting the development of sustainable finance in the bond and wider debt capital markets. ICMA provides the Secretariat for the Green Bond Principles (GBP), the Social Bond Principles (SBP), the Sustainability Bond Guidelines (SBG) and the Sustainability-Linked Bond Principles (SLBP) - collectively known as "the Principles" – which are the de facto global issuance standard for the international sustainable bond market (referenced by 97% of issuers in 2024). We also cooperate with other initiatives relating to sustainable bonds to ensure their consistency with the Principles.

ICMA plays a recognised leading role in supporting the development of sustainable finance in the bond and wider debt capital markets. ICMA provides the Secretariat for the Green Bond Principles (GBP), the Social Bond Principles (SBP), the Sustainability Bond Guidelines (SBG) and the Sustainability-Linked Bond Principles (SLBP) - collectively known as "the Principles" – which are the de facto global issuance standard for the international sustainable bond market (referenced by 97% of issuers in 2024). We also cooperate with other initiatives relating to sustainable bonds to ensure their consistency with the Principles.

ICMA coordinates work by its key constituencies and committees to provide sustainability guidance for other debt capital products such as repo. We further support regulatory and market efforts to provide Codes of Conduct for ESG Ratings and Data Products Providers.

ICMA actively engages with regulators globally notably by participating in expert groups and through regular responses and papers to promote the complementarity and interoperability of their initiatives with the Principles. In parallel, we publish thought leadership papers to provide market input into the policy and regulatory debate on key topics such as greenwashing and transition finance.

The main areas of the Sustainable Finance website section are:

- The Principles & related guidance

- Membership, governance & working groups of the Principles

- Codes of Conduct for ESG Ratings and Data Products Providers

- Sustainable Bond Market Data

- Regulatory responses & commentary

- Other sustainable finance guidance, research & initiatives

- Contacts & Principles Helpdesk

- Archive

Click here to view the latest Principles Newsletter (members only).